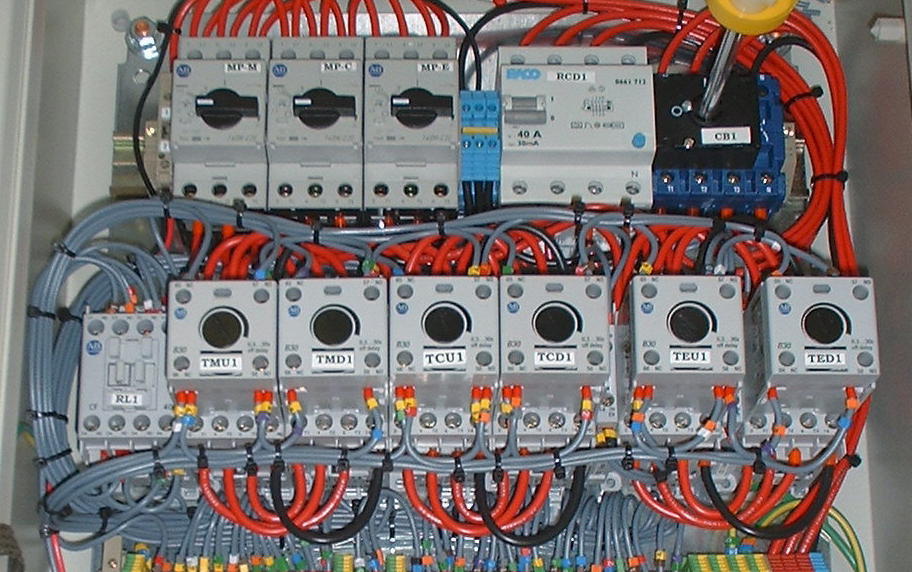

Control panel for Lichfield cathedral

Free video online - how to increase your productivity using ITClick here to see the free CHK video

Find out how you can gain a competitive advantage from using the latest information technology software with this free online video

showing you our own case history of how we use IT to boost productivityClick on a link below to find out more - or to get an online quote for your product specification. We will get back to you fast

Printed circuit boards and electronic equipment How much will it cost? Find out online.Online quote form for electronic equipmentOnline quote form for wound components Your guarantee of quality with every item of Crawford Hansford & Kimber electronic and electrical equipment comes from our ISO 9001 accreditation.The whole control system is devoted to obtaining quality in the design and manufacture of electronic equipment and transformers - such as printed circuit board assemblies, subassemblies, complete products, wound components, toroids, coils, specialist wiring, harnesses and looms.

We take your specification and produce a working prototype. This is then rigorously tested to ensure it meets all your requirements. The process of testing continues once manufacturing begins. In this way, we have brought the reject rate down to almost zero for delivered products. Our speciality is batch-run, purpose-designed products that exactly match your specifications and requirements. In fact, we guarantee we have met these requirements through the issue of Certificates of Conformity. Our experience in producing, literally, several thousand original designs gives you a vital cutting edge in the marketplace through the sheer reliability of the purpose-built components we produce for your products. What's more, we are engaged in a continuous programme of raising quality standards and cutting costs. We have, for example, now produced printed circuit boards that are fully compliant with RoHS requirements. In this way we can deliver the extra value and reliability your customers expect.

|

To guarantee this quality we go to what you might think are unusual lengths.

To guarantee this quality we go to what you might think are unusual lengths.